Renko Bars Indikator

This article is going to discuss one of these in detail, namely, the Renko Indicator. This article will also discuss renko charts, which are unusual in that they are. The MT4 platform does not offer a facility for generating Renko charts out of the box. The Quantum Trading Live Renko Charts indicator delivers the perfect chart.

Asking the question, what is the best Renko trading indicator probably isn’t going to lead to profitable day trading. I really don’t think there is a best indicator, regardless of the trading method.

However, if someone asked me about choosing the best Renko trading indicator[s] for developing a day trading method – that question I could answer. I would say to use a combination of different, but related Renko indicators that could be combined into a method trade setup. You would then evaluate the effectiveness of the indicator combination, by seeing how often price would continue to a profit target, after your Renko trade setup gave you a trade.

For instance, can your trade setups consistently make a profit 60% of the time or more, with you average winner bigger than your average loser? My experience is that trade setup combinations are much more effective than single indicators, and I don’t know of a single trading indicator that would be as profitable. Ratchet induktivnosti drosselya na ferritovom koljce. In that context, I think of Renko trading indicators as providing trade method setup information –vs- an indicator as a mechanical system. Best Renko Trading Indicator Combination We are going to look at what I have found as the best combination of indicators to use for Renko chart day trading.

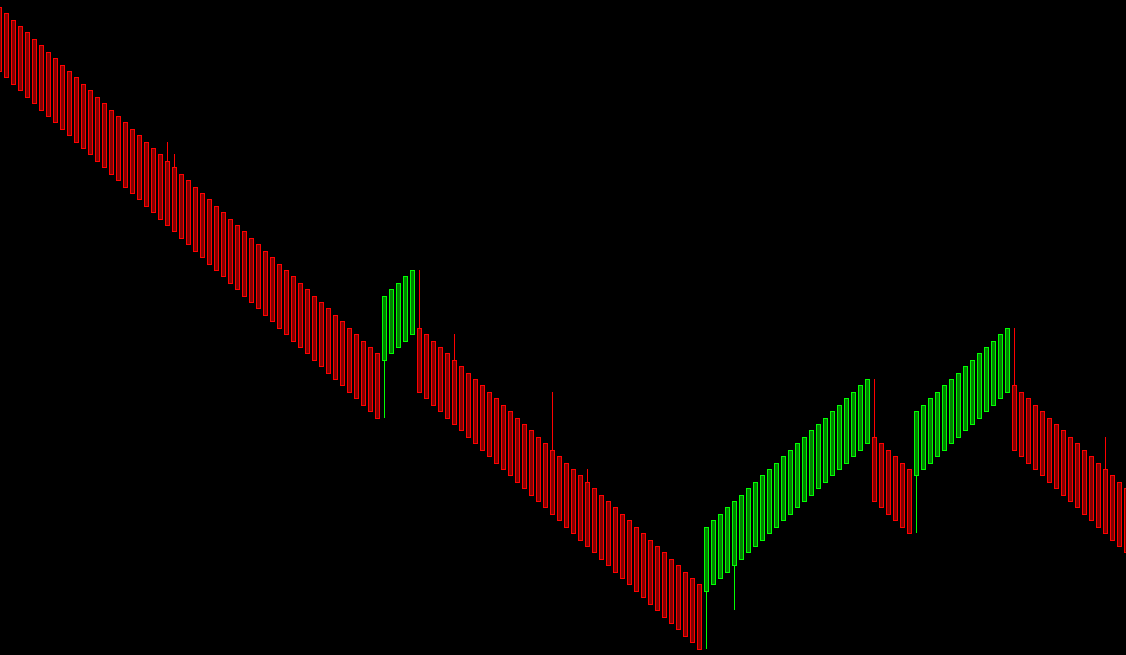

We use a combination of 3 Renko day trading indicators – these are seen on the chart below. These indicators are related in that they all give information about price momentum. And that is what I have found as the best Renko indicator combination for price continuation – a way of combining momentum into trade setups. Due to the importance of momentum and the way that it tends to lead price, our method will not take a trade against momentum. Futures and forex trading contains substantial risk and is not for every investor.

An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or lifestyle.

Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. CFTC RULE 4.41: Hypothetical or simulated performance results have certain limitations.

Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs, in general, are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.